Private Equity

Notre Cabinet a développé une expertise reconnue en private equity, notamment en matière de capital innovation (venture capital), de capital développement et de capital transmission (LBO) sur des opérations small et mid cap (valorisation d’entreprise comprise entre de 0 et 200M€).

Notre Cabinet a développé une expertise reconnue en private equity, notamment en matière de capital innovation (venture capital), de capital développement et de capital transmission (LBO) sur des opérations small et mid cap (valorisation d’entreprise comprise entre de 0 et 200M€).

L’équipe PE du Cabinet intervient à l’occasion d’opérations de levées de fonds / d’investissement ou d’acquisition sous la forme de LBO, aussi bien aux côtés d’investisseurs financiers (Fonds d’investissement, Corporate Venture, Family Office, Business Angels…), qu’aux cotés des sociétés cibles ou de leurs actionnaires / dirigeants.

Le Cabinet couvrant l’ensemble des segments du droit des affaires (« one stop shop »), notre équipe peut s’appuyer – avec une forte réactivité et cohésion interne – sur l’ensemble des expertises support nécessaires aux opérations qu’elle adresse (e.g. fiscalité corporate, IT, public, social, concurrence, financement).

Nous intervenons couramment dans le cadre d’audits pré-acquisition / pré-investissement, de la structuration juridique et fiscale des opérations, de la mise en place de plans d’intéressement de cadres dirigeants ou salariés (« management packages »), de la rédaction et de la négociation de la documentation transactionnelle (lettres d’intention ou termsheets, protocoles d’investissement, pactes d’actionnaires, conventions de garantie, …) et corporate (documentation sociale).

@start-ups : nous défendons quotidiennement la culture de l’innovation en s’investissant dans l’écosystème des start-ups et en développant des approches qui démocratisent la collaboration avec nos clients. Avec l’offre Stand By Me, nous sommes l’un des rares cabinets d’affaires de 1er plan à proposer des solutions d’accompagnement juridiques, fiscales et sociales, pensées pour répondre aux besoins des start-ups aux différents stades de leur développement.

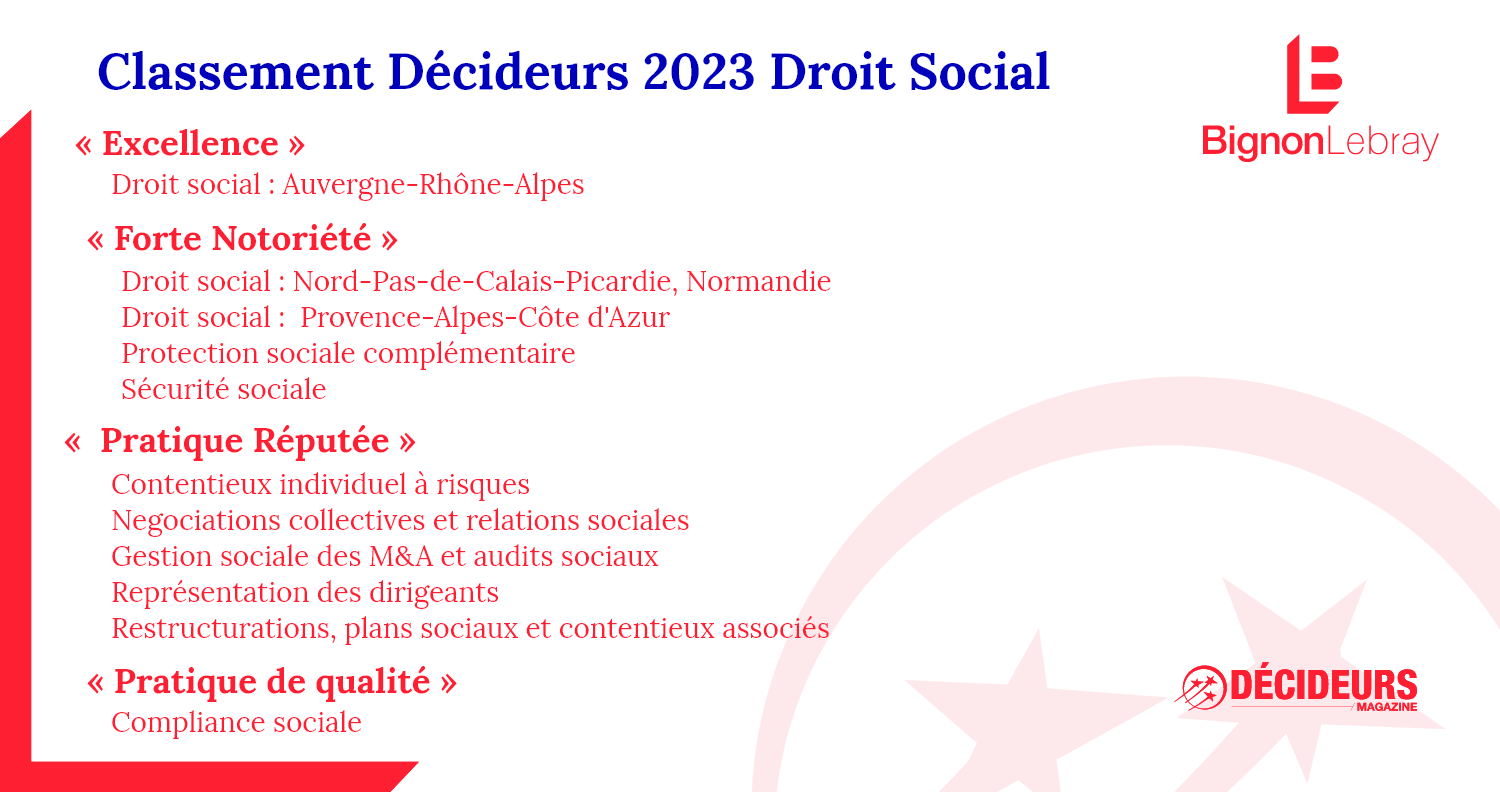

Nos dernières distinctions :

Ils nous font confiance

- Capital Croissance et Turenne Capital Partenaires dans le cadre de leur investissement dans Teaminside Group

- New Alpha Verto dans le cadre d’un LBO primaire visant les groupes OMP Transport et G.P.I

- Crédit Mutuel Arkéa dans le cadre de la levée de fonds de la startup wilov

Bon à savoir

- Depuis 2018, l’équipe PE a généralisé l’usage de la signature électronique (via sa propre plateforme paramétrée par docusign) afin de simplifier et d’alléger les processus de signing / closing ;

- L’équipe PE assure une veille juridico-financière permanente (réunions internes et newsletters mensuelles) et participe à de nombreux événements et organisations de place afin de rester au contact des tendances de marché ; plus de 20 avocats composent l’équipe : une équipe à dimension humaine structurée selon une cohésion et organisation interne forte ;

- Nous faisons preuve d’une grande réactivité et proximité à l’égard de nos clients, avec une volonté d’adresser vos sujets selon une approche entrepreneuriale et de capitaliser sur la valeur ajoutée